Bitcoin Magazine

Samourai Letter #3: Notes From The Inside

Dear Reader,

Since my last letter where I tried to explain the underground economy of FPC Morgantown I have been struggling to come up with an idea of what further information you may be interested in.

In modern life on the outside we are all so used to immediate feedback on everything we do. We write and publish an article and almost instantly comments start to roll in. You push to Twitter and the peanut gallery chimes in and has their say, and you as the content creator have an immediate idea of the general sentiment surrounding your work.

It takes some getting used to not having that modern feedback loop, but on the other hand it is quite liberating as well. All that said I have decided that today I am going to write you about the food situation at FPC Morgantown. I hope this letter will be interesting to you. Feel free to write me a letter with your thoughts and suggestions. My address will be posted at the bottom of this letter.

One of the things I have been doing regularly since arriving at FPC Morgantown is keeping a daily journal. Usually towards the end of my day around 8:00PM I sit at a desk flanked by chess tables and write a summary of the days events. I write about any thoughts I had throughout the day or any incidents that have occurred. When I first got here I only had some blank white printer paper and a very uncomfortable pen (thanks to Omar who provided me with these supplies).

Now, after a shopping trip to the commissary I have a wide ruled notebook and a slightly more comfortable pen. In any case, around the third day of journaling I realized a great majority of what I was writing about was about food or at least somewhat tangentially related to food. I now make an effort to avoid writing about the food in my daily journal as it gets repetitive.

However it got me pondering why so much of my energy went to writing about the food served in the “Chow Hall”. The conclusion I have come to is that so much of a prisoners day revolves around the three main meals and food quantity, quality, and variety in general, that it becomes a naturally big part of our daily life.

At 6:00 AM a crackling static hiss fills the empty hallways and the sleeping rooms of the housing unit. A loud announcement proceeds from the overhead speakers embedded in the ceiling: “ATTENTION BATES UNIT: MAINLINE IS NOW OPEN”. This is our first call to food of the day. “Mainline” is some BOP lingo to mean meal time.

Most prisoners avoid the 10 minute walk to the Chow Hall at this call to breakfast – myself included now. On Monday, Wednesday, and Friday there is supposed to be a “hot breakfast” which could be pancakes (always stodgy and undercooked) served with a brown liquid in a condiment package that is apparently margarine and another brown liquid in a condiment package which is some sort of syrup; French toast (actually pretty tasty) served with the same margarine and syrup; or biscuits and gravy (biscuits are good, avoid the gray soup that is less gravy and more dirty laundry water).

Each of these is served with oatmeal or grits both quite tasteless and reminiscent of wallpaper paste. Though more often than not we do not get any of those things, we get something they call “spice cake” which is a giant piece of cake (without icing) where the batter is mixed with cinnamon until it turns brown. It doesn’t taste terrible, but one starts to resent the taste of cinnamon cake when it is served every morning (and again for lunch if there is any left over from breakfast – and there always is).

Every other day is what we call Cold Breakfast. This consists of some sort of bran flake so stale it is reminiscent of eating cardboard. Even the most stoic prisoner who attends every breakfast will otherwise avoid the Chow Hall on a cold breakfast day.

I do not remember if I told you about the multitude of ducks and geese who live on the compound. They were supposed to migrate south for winter at some point in the past, but instead they found such a hospitable environment among the prisoners who happily feed them leftovers (against the rules by the way) that they decided to forgo the instinct to migrate to warmth and stay here year round.

They reproduced in the way only animals can and now there must be hundreds of geese and mallard ducks that waddle around the entire compound. These prisoner water fowl know the food schedule just as well as us human prisoners do. They wait by the exit of the Chow Hall for altruistic prisoners to throw them a few pieces of bread after every meal, quacking and squawking demanding their fair share. On Cold Breakfast days, throw the fowl the bran flakes and each one will refuse to eat them. That should tell you everything about the universally hated Bran Flakes.

In any case, the 6:00AM Breakfast is the only time you have access to milk. You are offered two small cartons of fat free skim milk – which appears to be closer to water than milk – that is often several days expired.

Usually the milk is still drinkable, sometimes however the carton swells so much it appears it is about to explode. That is a good indication the milk has soured. If you are given a sour milk, tough luck. The breakfast mainline closes somewhere around 20 minutes after it is called, so you scarf down your cake and oatmeal, you drink your two cartons of skim milk (or more commonly you pocket the milk to bring back to the housing unit for later use – which by the way is against the rules and may result in disciplinary action for contraband – with a more appetizing cereal you purchased from the Commissary). You make the 10 minute journey back to the housing unit to await the next break in the monotony of your life. Mainline lunch call.

Lunch mainline is called around 10:45 AM. Calling it lunch is quite generous, really it is late breakfast. Indeed we often get “breakfast for lunch” which is quite universally hated on the compound.

Cold scrambled eggs are usually on the breakfast for lunch menu. You really never know what you’re going to get at lunch time. They post a menu for the week in the housing unit, but from experience that appears to be more aspirational than factual. Some days you will receive a massive portion of “chicken fried rice” which is neither chicken or fried rice. It is turkey and some vegetables with some rice, but it is quite tasty, and somewhat nutritious.

Other times you will get an overcooked tiny hamburger patty – that appears to be a piece of leather recycled from our issued work boots – on a stale and occasionally moldy bun with a few onions, a tomato slice, and some iceberg lettuce. We had this yesterday in fact, and it put a damper on the mood across the whole compound. As I put it to my cellmate Mike, “When the onions, tomato, and bun are the star of the show instead of the beef, that is a bad burger”.

Portion sizes vary wildly. If the kitchen workers serving that day are black and you are black you likely will receive a bigger portion, maybe a second shoe leather patty. If they are Hispanic they likewise show favor to those of their heritage. I am not black, and while Hispanic, I do not speak Spanish and I look like a gringo, so no extra portions for me. Besides portion size disparity there is also a massive gulf in seasoning reliability. There are times that so much salt has been added you need a gallon of water by your side to replenish your fluids as you eat. Other times it is as if salt is the equivalent of gold and must not ever be used on something so trivial as food. Lunch ends around 11:15 and off we are sent to carry on with our day.

Dinner mainline is called around 4:45 PM. I would consider this a late lunch but I do recognize that many people (my dear wife included) consider this an acceptable supper time. Again, the general rule is to expect anything.

It may be something delicious or something inedible. You may get a double portion if you are the right race or a half portion if the server doesn’t like the look of you. It may be over seasoned, under seasoned, not seasoned at all. It may be listed on the calendar and it may not be. You never know what to expect, and that is my entire longwinded point as to why the food is such a popular thing to discuss among the prisoners here, and has taken up so much of my energy during my daily journals.

Our entire day is couched by calls to eat food. 6:00, 10:45, 4:45, and each and every time it is called it is entirely unpredictable. Every other aspect of our lives here is extremely regimented, extremely predictable, very monotonous. But heading to the Chow Hall three times a day, that is throwing the dice of fate, that is an unknown variable in a well known equation.

That is something different every day to talk about. You see the same people over and over again in your Unit. You run into the same person 50 times a day, and frankly you run out of things to say. You can only talk about how fucked up the Feds are, how you were shafted by the prosecutors, how your Judge was a bitch, so many times. The unknown variable of Chow Hall three times a day injects new blood into what could become a very stale social situation. Shared disgust at a horrible meal. Incredibility at how delicious the chicken parmesan was. Complaint at breakfast for lunch again! The shared ordeal of meal times maintains a common social order.

You may have gathered from the above paragraphs that the food quality generally is quite low. Most ingredients are supplied by vendors who can get away with selling expired and close to rotten ingredients to the prison system. I have heard from kitchen staff that many boxes arrive in the kitchen labeled “Not For Human Consumption”. Our potatoes are mouldy, our canned vegetables long expired, our protein suspicious.

You couldn’t legally give this quality of food away on the outside, but you can legally sell it to the BOP who will use it to feed the adults in their custody. Besides low quality ingredients and bland to actively disgusting recipes the nutritional value of our meals is extremely low. If you are a die hard disciple of the USDA Food Pyramid – bunk nutritional science that everyone but the slow moving feds recognize as a national tragedy, responsible for the exceptional rise of obesity rates – then yes, I suppose we are getting – on paper – the required nutritional value out of every meal.

The on-the-ground results of a prolonged diet like one we are subjected to does not lie. I have spoke with many different prisoners, several of them doctors, who have come into the prison system as healthy adults and after several years of custody have developed chronic health problems. High blood pressure and high cholesterol seem to be the most common problems reported. Almost every prisoner is on some sort of prescribed medication for some ailment they developed whilst in custody.

Because of the problems I have described. Many prisoners do not bother with the meal time calls to Chow Hall. I have met several prisoners who never go to the Chow Hall and only buy prepared food or cook for themselves. This is also not an ideal solution. The food items the commissary sells must be shelf stable, nothing that can spoil without refrigeration.

This naturally means nearly everything is packed to the gills with preservatives and salt. On my first commissary day I purchased 10 pouches of chicken breast, several bags of quick cook ‘minute rice’, several pouches of dried mash potatoes, small bags of shredded mozzarella cheese (there is no expiration date on the cheese, so I suspect it is more preservatives than cheese), 10 pouches of tuna, mayonnaise (again, no need to refrigerate so quite suspicious), hot sauce (vital for making the Chow Hall food more palatable), salt, pepper, onion flakes, garlic powder, soy sauce, jelly, peanut butter, individually wrapped bagels, dried milk, and frosted flakes cereal.

Next time I plan on buying granola, oatmeal, protein shakes, and tortillas. The food I am able to prepare is tastier than the chow hall, but I am not yet sure if it is healthier. It is also quite difficult. The only cooking tools legally available to you is: on demand hot water (190 degrees F) and a half gallon plastic jug. It takes some trial and error to cook under those conditions. It is a lot of hassle and expense which makes cooking for yourself prohibitive for those prisoners only relying on their prison jobs.

Almost everyone on the outside who hasn’t been to prison themselves or have a loved one incarcerated does not think about the basic needs that individuals have in custody, or how those needs are met. The food and nutrition in the system is woefully inadequate. We need higher quality ingredients, fresh fruit and vegetables, and far more protein. We need better options for cooking our own food within the unit, something more than hot water. We need access to refrigeration so we can keep fresh produce and items not filled with preservatives.

Thank you for reading this letter from the inside. I do not mean to use this opportunity writing you to complain. “It is prison after all” some of you will say, “it is not meant to be nice”. Anyway, complaining isn’t in my nature, and it often does nothing but make you and everyone around you miserable. I don’t write this letter looking for sympathy or condolences, I write to simply inform you of my reality, and the reality of countless number of people in the custody of the BOP. Happy New Year dear reader. I hope 2026 brings you (and me) great opportunities.

Sincerely,

Keonne

Write to Keonne:

Keonne Rodriguez

11404-511

FPC Morgantown

FEDERAL PRISON CAMP

P.O. BOX 1000

MORGANTOWN, WV 26507

Mailing Guidelines:

Please note: You can only send letters (no more than 3 pages long). No packages or other items are allowed. Books, magazines, and newspapers must be sent directly from the publisher or an online retailer like Amazon. All letters must include a full return address and sender name to be delivered.

This post Samourai Letter #3: Notes From The Inside first appeared on Bitcoin Magazine and is written by Keonne Rodriguez.

Source: Bitcoin Magazine – Read More

Think this might be you? Take the “

Think this might be you? Take the “

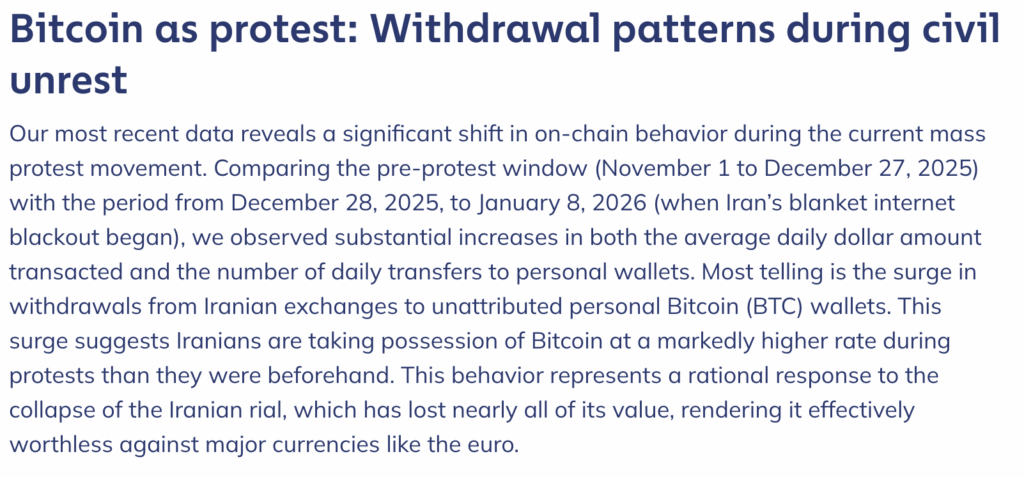

Iran’s currency has collapsed and is now officially worth $0.

Iran’s currency has collapsed and is now officially worth $0.

Social Media