Bitcoin Magazine

Bitcoin Covenants: OP_VAULT (BIP 345)

This is the fourth article in a series deep diving into individual covenant proposals that have reached a point of maturity meriting an in-depth breakdown.

OP_VAULT, put forward by James O’Beirne in BIP 345 (with Greg Sanders added later as a co-author), is a covenant designed to implement vaults. It depends additionally on CTV (or TXHASH or other similar opcodes) to complete the construction of a vault.

Before getting into how the proposal itself works, let’s look at what a vault is trying to accomplish.

The purpose of a vault is to improve the security of your bitcoin storage. This is accomplished by the introduction of a delay period during any attempt to spend from the vault. Rather than being able to directly send your bitcoin from the vault, the vault restricts them so that they can only be sent to a “middle ground” address. While coins being withdrawn from the vault are in this middle ground state, they can be spent at any time into a deep cold storage wallet under your control (ideally a geographically distributed vault multisig), and only to that deep cold storage. After a pre-defined timelock the coins can then be spent onwards to the ultimate intended destination.

This is something that is possible to do currently with pre-signed transactions, but that brings a large degree of complexity, inefficiency, lack of flexibility, and risk of losing funds.

Using pre-signed transactions requires you to decide ahead of time how much money will be withdrawn at a time, what feerate the transactions withdrawing from the vault will pay, what the interim address before fully withdrawing is, and then you have to securely delete the private keys used to pre-sign all these transactions.

A big problem with this architecture, aside from the overall restrictions of pre-decided amounts, fees, etc., is that address reuse is not safe. In a pre-signed transaction vault scheme, deposits are sent to the address used to pre-sign the initial vault transaction, and that along with all the other keys involved are deleted after signing the vault transactions. Address reuse is bad practice, but you cannot stop someone else from sending funds to an address they have used before. Any such later deposited funds would be forever lost, as the vault keys have all been deleted.

As well, every deposit into a vault necessitates a fresh set up of new keys, conducting the pre-signing ceremony all over again for the new set of transactions, ensuring the new set of keys are securely deleted, and managing the proper storage of all this information including redundant backups. Every single deposit creates an opportunity for something to get messed up during the vault set up, every deposit offers a chance for someone who has compromised a system or device since the last deposit to try to steal your funds.

Pre-signed transaction vaults are a cumbersome and complicated construction, and present enough complexity that each use does present a non-negligible risk of messing up in a way that results in lost funds.

Improvements can be made with CTV, such as doing away with the need to securely delete keys, but the rest of the complexity and risk still remains. Amounts and fees must still be pre-defined. Address reuse can still lead to fund loss.

How OP_VAULT Works

OP_VAULT is built on Taproot, meaning the entire design uses tapscript and depends on the existence of taptrees and the script spending path. It also depends on the use of CTV (or TXHASH/similar functionality) to construct a full vault.

The proposal is actually two opcodes, OP_VAULT, and OP_VAULT_RECOVER. OP_VAULT is used to trigger withdrawals from the vault, and OP_VAULT_RECOVER is used to sweep triggered withdrawals into the deep recovery wallet. The idea is to construct a taptree that has OP_VAULT paths in it for withdrawals, and UP_VAULT_RECOVER paths for sweeping any funds mid-withdrawal to a secure cold wallet. This taptree is your vault.

OP_VAULT works by restricting how the outputs of a transaction spending an OP_VAULT encumbered coin must look. The opcode expects in the witness:

- A tapleaf script body

- The number of data pieces for a script update

- An output index for the withdrawal

- An output index for any funds going back into the vault

- An amount of satoshis going back into the vault

OP_VAULT ensures that the correct amount of funds sent back to the vault is correct, and that the output script of that output is identical to the taptree being spent from. It also takes the tapleaf script body, and the data variables provided, and combines them into a full tapleaf script. It then ensures that the output specified for withdrawal has an identical script with the taptree of the input being spent, except the tapleaf being spent from is replaced with the tapleaf script put together with data from the witness.

This last trick is possible because in order to verify the tapleaf is part of the taptree in the first place the interior nodes of the merkle tree have to be present to verify. Hashing the new script with the known interior leaves of the rest of the tree ensures that only that leaf of the tree was changed. The template for the script that dynamically be filled in is defined at the time of vault creation. For a typical vault use-case the script template would simply be a timelocked CTV spend path with the hash provided when triggering a withdrawal.

OP_VAULT_RECOVER is much simpler. It takes a hash of the recovery script, and an output index for the recovery transaction. That output must contain a script that exactly matches the predefined hash, and the entirety of the amount of funds in the input being recovered must go to that output.

Both of these scripts can be “gated” with an authorization script, i.e. providing a signature from a specific key in order to trigger a withdrawal or initiate a recovery. This has some trade offs. If you lose a recovery authorization key, you can no longer trigger a recovery transaction in the event of a theft of your withdrawal trigger key. It does however, allow you to initiate a recovery from multiple vault UTXOs in the same transaction due to specifying each input’s corresponding outputs manually.

What Is OP_VAULT Good For

Obviously vaults. OP_VAULT cleanly addresses all the major limitations of a pre-signed transaction or CTV based vault. No restrictive pre-decided denominations or pre-decided fees, no danger in reusing addresses, and no necessity to deal with a high security issue like key deletion every single time you deposit.

It is a lot more flexible than just vaults though. That was the intended use case when it was designed, but it is a much more general covenant guaranteeing that a taptree actually carries forward to the next UTXO when you want it to, with pre-defined exit conditions that have some degree of flexibility.

You can make something very close to a Drivechain with OP_VAULT. Create a vault template that has an incredibly long timelock, on the order of 3-6 months (similar to Drivechain withdrawals). Have no authorization gate for any script and make the template public. People can now simply deposit funds into the “drivechain” by sending money to that vault script. Anyone can propose a withdrawal by simply spending from an OP_VAULT path and including a CTV hash of their withdrawal transaction. Miners can enforce this by simply refusing to mine any invalid withdrawal transactions, and if a malicious miner ever mined a malicious withdrawal trigger, the next honest miner could simply revault the funds.

That is what can be done just using an identical script template as recommended in the BIP. The script template set for withdrawals is arbitrary, and as such is potentially very general in terms of what types of self-perpetuating contracts OP_VAULT could enable.

Closing Thoughts

OP_VAULT clearly accomplishes the goal of enabling proper vaults that do not come with the restrictions, complexities, and risk that pre-signed transaction vaults (or even simpler covenant vaults with something like CTV) come with. However, in doing so it wound up introducing a rather wide and generalized set of functionalities to accomplish that original goal.

The proposal would definitively enable a relatively smooth and secure vault functionality, but it also opens up many other doors. Drivechains are something that come with a large degree of risk centered around Miner Extractible Value (MEV). The downsides of enabling such functionality, and the incentive issues and consequences it could have, should be weighed against the upside of enabling a well constructed vault.

OP_VAULT is a relatively mature proposal, but the degree of functionality that it enables shouldn’t be approached lightly.

This post Bitcoin Covenants: OP_VAULT (BIP 345) first appeared on Bitcoin Magazine and is written by Shinobi.

Source: Bitcoin Magazine –

Canada’s Conservative party leader Pierre Poilievre was poised to win the election by a landslide, until U.S. President Donald Trump threatened to annex the country. Mark Carney Assumes Power After Trump Took Center Stage in Canada’s Federal Election Mark Carney, the shadowy former governor of Canada’s central bank, was elected as Prime Minister on Monday […]

Canada’s Conservative party leader Pierre Poilievre was poised to win the election by a landslide, until U.S. President Donald Trump threatened to annex the country. Mark Carney Assumes Power After Trump Took Center Stage in Canada’s Federal Election Mark Carney, the shadowy former governor of Canada’s central bank, was elected as Prime Minister on Monday […]

World, the biometric cryptocurrency and ID project, has launched Build Latam in Argentina, a program aimed at empowering tech projects to leverage World’s services in their products. Martín Mazza, Tools for Humanity regional manager for Latin America, explained the new security measures the project has implemented to protect user data. World Launches Latam-Focused Incentives, Discusses […]

World, the biometric cryptocurrency and ID project, has launched Build Latam in Argentina, a program aimed at empowering tech projects to leverage World’s services in their products. Martín Mazza, Tools for Humanity regional manager for Latin America, explained the new security measures the project has implemented to protect user data. World Launches Latam-Focused Incentives, Discusses […]

On Tuesday, the crypto economy edged 0.51% higher over the past 24 hours, cruising at a valuation of $2.98 trillion, with bitcoin ticking up 0.5% and ethereum climbing 1.5% in the same window. Meanwhile, SAFE token vaulted more than 23% today, while AI16Z appreciated by 9.29% against the U.S. dollar. Wall Street Ends Up, Crypto […]

On Tuesday, the crypto economy edged 0.51% higher over the past 24 hours, cruising at a valuation of $2.98 trillion, with bitcoin ticking up 0.5% and ethereum climbing 1.5% in the same window. Meanwhile, SAFE token vaulted more than 23% today, while AI16Z appreciated by 9.29% against the U.S. dollar. Wall Street Ends Up, Crypto […]

The government of the UAE has launched what it calls the first AI-based legislative system, allowing synthetic agents to develop laws and monitor their effects through big data analysis. UAE Enables AI Interaction in Lawmaking With New Smart Legislative System Artificial Intelligence (AI) has begun to penetrate all aspects of human life, and governance is […]

The government of the UAE has launched what it calls the first AI-based legislative system, allowing synthetic agents to develop laws and monitor their effects through big data analysis. UAE Enables AI Interaction in Lawmaking With New Smart Legislative System Artificial Intelligence (AI) has begun to penetrate all aspects of human life, and governance is […]

Compass Mining has initiated operations at the first phase of its self-owned bitcoin mining facility in Iowa, the company announced on Tuesday. Compass Mining Powers Up First Phase of 30 MW Iowa Project The initial 8-megawatt (MW) phase of the 30 MW project is now online, with construction on remaining capacity set to begin in […]

Compass Mining has initiated operations at the first phase of its self-owned bitcoin mining facility in Iowa, the company announced on Tuesday. Compass Mining Powers Up First Phase of 30 MW Iowa Project The initial 8-megawatt (MW) phase of the 30 MW project is now online, with construction on remaining capacity set to begin in […]

The U.S. Securities and Exchange Commission (SEC) has delayed a decision on whether to approve the listing of Franklin Templeton’s proposed exchange-traded fund (ETF) tied to XRP, extending its review period by 45 days. SEC Takes Additional 45 Days to Assess Franklin XRP Fund Filing The SEC announced Tuesday it will defer its ruling on […]

The U.S. Securities and Exchange Commission (SEC) has delayed a decision on whether to approve the listing of Franklin Templeton’s proposed exchange-traded fund (ETF) tied to XRP, extending its review period by 45 days. SEC Takes Additional 45 Days to Assess Franklin XRP Fund Filing The SEC announced Tuesday it will defer its ruling on […]

Federal prosecutors have asked a judge to sentence former Celsius Network CEO Alex Mashinsky to at least 20 years in prison for orchestrating a multiyear fraud that caused over $550 million in losses to cryptocurrency investors. Mashinsky’s $48M Gain from Celsius Collapse Demands 20 Years, Prosecutors Say In a sentencing memorandum filed April 28, the […]

Federal prosecutors have asked a judge to sentence former Celsius Network CEO Alex Mashinsky to at least 20 years in prison for orchestrating a multiyear fraud that caused over $550 million in losses to cryptocurrency investors. Mashinsky’s $48M Gain from Celsius Collapse Demands 20 Years, Prosecutors Say In a sentencing memorandum filed April 28, the […]

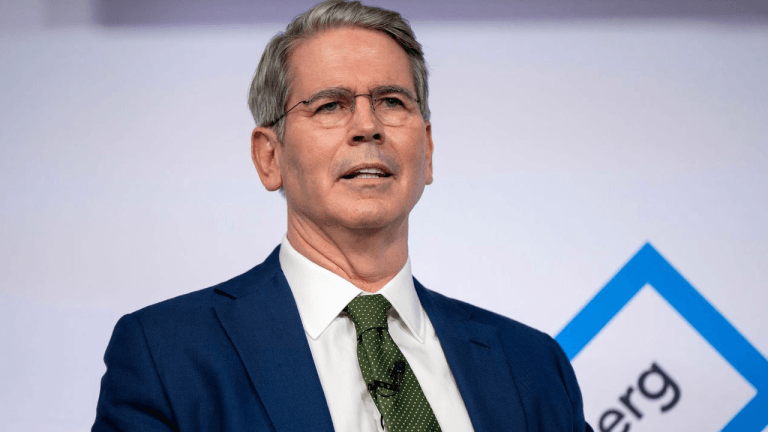

U.S. Treasury Secretary Scott Bessent, the 79th Secretary of the Treasury, addressed trade tensions with China during a White House press conference, emphasizing that Beijing faces severe economic consequences if tariffs remain high. ‘Certainty Not Necessarily Good’: Bessent Defends Strategy Amid Stock Market Stall Amid efforts to highlight President Trump’s policy achievements during his second […]

U.S. Treasury Secretary Scott Bessent, the 79th Secretary of the Treasury, addressed trade tensions with China during a White House press conference, emphasizing that Beijing faces severe economic consequences if tariffs remain high. ‘Certainty Not Necessarily Good’: Bessent Defends Strategy Amid Stock Market Stall Amid efforts to highlight President Trump’s policy achievements during his second […]

Research from Standard Chartered Bank shows a marked exodus from spot gold exchange-traded funds (ETFs) to bitcoin ETFs. Gold vs. Bitcoin: ETFs Show Shifting Investor Sentiment as BTC Holds $95K London-based Standard Chartered Bank published research on Tuesday showing a migration of investor capital from spot gold ETFs to bitcoin ETFs, as the cryptocurrency held […]

Research from Standard Chartered Bank shows a marked exodus from spot gold exchange-traded funds (ETFs) to bitcoin ETFs. Gold vs. Bitcoin: ETFs Show Shifting Investor Sentiment as BTC Holds $95K London-based Standard Chartered Bank published research on Tuesday showing a migration of investor capital from spot gold ETFs to bitcoin ETFs, as the cryptocurrency held […]

This content is provided by a sponsor. PRESS RELEASE. George Town, Grand Cayman, Cayman Islands – April 29, 2025 – P2P.org, a leading validation and staking provider across multiple blockchain networks, has been officially elected as a TRON Super Representative (SR), supporting TRON’s mission to decentralize the internet through blockchain technology. This strategic integration strengthens […]

This content is provided by a sponsor. PRESS RELEASE. George Town, Grand Cayman, Cayman Islands – April 29, 2025 – P2P.org, a leading validation and staking provider across multiple blockchain networks, has been officially elected as a TRON Super Representative (SR), supporting TRON’s mission to decentralize the internet through blockchain technology. This strategic integration strengthens […]

Messika, the Parisian fine jewelry brand, now accepts cryptocurrency payments across its boutiques and online store, embracing bitcoin, ether, USDT, and solana through a seamless integration with Lunu. Messika Now Accepts Bitcoin and Other Cryptocurrencies Worldwide Paris-based fine jewelry house Messika has taken a major step into the future of luxury retail, announcing it now […]

Messika, the Parisian fine jewelry brand, now accepts cryptocurrency payments across its boutiques and online store, embracing bitcoin, ether, USDT, and solana through a seamless integration with Lunu. Messika Now Accepts Bitcoin and Other Cryptocurrencies Worldwide Paris-based fine jewelry house Messika has taken a major step into the future of luxury retail, announcing it now […]

Mastercard is turbocharging the future of payments with a sweeping launch of global stablecoin capabilities, revolutionizing digital wallets, merchant checkouts, and cross-border transactions. Mastercard Unveils Full-Scale Stablecoin Payments Network Globally Mastercard announced on April 28 a major step forward in digital payments by unveiling global, end-to-end capabilities aimed at enabling stablecoin transactions from digital wallets […]

Mastercard is turbocharging the future of payments with a sweeping launch of global stablecoin capabilities, revolutionizing digital wallets, merchant checkouts, and cross-border transactions. Mastercard Unveils Full-Scale Stablecoin Payments Network Globally Mastercard announced on April 28 a major step forward in digital payments by unveiling global, end-to-end capabilities aimed at enabling stablecoin transactions from digital wallets […]

Coinbase’s CEO is urging companies to dive into crypto’s explosive growth, championing unstoppable institutional adoption and a soaring total addressable market transforming global finance forever. ‘The Water Is Warm, Everyone Should Come in’ Brian Armstrong, CEO of crypto exchange Coinbase (Nasdaq: COIN), responded Monday on social media platform X to commentary crediting Coinbase with steering […]

Coinbase’s CEO is urging companies to dive into crypto’s explosive growth, championing unstoppable institutional adoption and a soaring total addressable market transforming global finance forever. ‘The Water Is Warm, Everyone Should Come in’ Brian Armstrong, CEO of crypto exchange Coinbase (Nasdaq: COIN), responded Monday on social media platform X to commentary crediting Coinbase with steering […]

Citi forecasts U.S. dollar stablecoins could surge to $3.7 trillion in the bull case, driving an unprecedented blockchain-fueled transformation of global finance by 2030. US Dollar Stablecoins Set to Dominate Amid Global Blockchain Frenzy, Says Citi Citi’s Global Perspectives and Solutions division released a new report titled “Digital Dollars—Banks and Public Sector Drive Blockchain Adoption” […]

Citi forecasts U.S. dollar stablecoins could surge to $3.7 trillion in the bull case, driving an unprecedented blockchain-fueled transformation of global finance by 2030. US Dollar Stablecoins Set to Dominate Amid Global Blockchain Frenzy, Says Citi Citi’s Global Perspectives and Solutions division released a new report titled “Digital Dollars—Banks and Public Sector Drive Blockchain Adoption” […]

Nasdaq is revolutionizing the future of digital assets with a bold framework to seamlessly fuse crypto into U.S. capital markets while safeguarding investors, laying the groundwork for a major financial transformation. Nasdaq Unveils Ambitious Digital Asset Integration Framework Nasdaq Inc. has proposed a comprehensive new regulatory framework aimed at integrating digital assets into the existing […]

Nasdaq is revolutionizing the future of digital assets with a bold framework to seamlessly fuse crypto into U.S. capital markets while safeguarding investors, laying the groundwork for a major financial transformation. Nasdaq Unveils Ambitious Digital Asset Integration Framework Nasdaq Inc. has proposed a comprehensive new regulatory framework aimed at integrating digital assets into the existing […]

Coinbase unleashes a game-changing Bitcoin Yield Fund, offering powerful returns with minimized risk, revolutionizing institutional crypto investing and setting a new gold standard for secure yield. Coinbase Launches Bitcoin Yield Fund, Avoiding High-Risk Loans and Call Selling Crypto exchange Coinbase (Nasdaq: COIN) announced on April 28 the launch of the Coinbase Bitcoin Yield Fund (CBYF), […]

Coinbase unleashes a game-changing Bitcoin Yield Fund, offering powerful returns with minimized risk, revolutionizing institutional crypto investing and setting a new gold standard for secure yield. Coinbase Launches Bitcoin Yield Fund, Avoiding High-Risk Loans and Call Selling Crypto exchange Coinbase (Nasdaq: COIN) announced on April 28 the launch of the Coinbase Bitcoin Yield Fund (CBYF), […]

The London-based bank released its forecast in a research report published on Monday, predicting a new bitcoin all-time high of $120K by the summer, followed by a $200K price by the end of December. Standard Chartered Sees Bitcoin Soaring to $200K in 2025 Geoffrey Kendrick, head of digital assets research at Standard Chartered, is doubling […]

The London-based bank released its forecast in a research report published on Monday, predicting a new bitcoin all-time high of $120K by the summer, followed by a $200K price by the end of December. Standard Chartered Sees Bitcoin Soaring to $200K in 2025 Geoffrey Kendrick, head of digital assets research at Standard Chartered, is doubling […]

The Stacks Asia DLT Foundation has officially registered in the Abu Dhabi Global Market (ADGM), becoming the first Bitcoin-based foundation to establish a presence in the financial center. Bitcoin L2 Projects Get Support Through New ADGM Registration According to the announcement shared with Bitcoin.com News, the foundation’s move aims to support Bitcoin layer two (L2) […]

The Stacks Asia DLT Foundation has officially registered in the Abu Dhabi Global Market (ADGM), becoming the first Bitcoin-based foundation to establish a presence in the financial center. Bitcoin L2 Projects Get Support Through New ADGM Registration According to the announcement shared with Bitcoin.com News, the foundation’s move aims to support Bitcoin layer two (L2) […]

Tether Holdings has released its first-quarter 2025 attestation for Tether Gold (XAUT), confirming that more than 7.7 tons of physical gold fully back the tokens in circulation. Tether Releases Independent Verification of XAUT Reserves Tether’s attestation report, completed by BDO Italia S.p.A., independently verified that 246,524.33 fine troy ounces of gold were held in custody […]

Tether Holdings has released its first-quarter 2025 attestation for Tether Gold (XAUT), confirming that more than 7.7 tons of physical gold fully back the tokens in circulation. Tether Releases Independent Verification of XAUT Reserves Tether’s attestation report, completed by BDO Italia S.p.A., independently verified that 246,524.33 fine troy ounces of gold were held in custody […]

Digital asset funds saw a surge of $3.4 billion in inflows last week, marking the third-largest on record, as investors seek alternatives amid sustained concerns over tariffs. Bitcoin and Ethereum Lead Digital Asset Inflows Digital asset investment products recorded a massive $3.4 billion in inflows last week, the third-largest weekly total on record, according to […]

Digital asset funds saw a surge of $3.4 billion in inflows last week, marking the third-largest on record, as investors seek alternatives amid sustained concerns over tariffs. Bitcoin and Ethereum Lead Digital Asset Inflows Digital asset investment products recorded a massive $3.4 billion in inflows last week, the third-largest weekly total on record, according to […]

Social Media